A college business professor once told me, “If you launch a token, it’s the beginning of the end, even if you haven’t begun.” Now, he was a TradFi dude reluctantly teaching DeFi to us Gen Zers at the peak of $DOGE’s success, and I figured he was just bitter. But joining the workforce, I learned a hard truth: creating isn’t free because you pay in time that could be spent elsewhere. Creators have to earn enough to justify the cost of creating. Luckily, web3 offers a payment of sorts: creator tokens and therefore self-DAOification.

Creators drop a token, fans of their work buy it, and around the creator a new DAO burgeons. They empower content creators by enabling them to monetize their work directly without intermediaries. That’s sick. It makes sense why social tokens were huuuuuge during the bull market. Recall the height of Song-a-Day-Man and Friends with Benefits. They have certainly felt the highs of the bull. But more than most sectors, social tokens and social token enablers have felt the very, very bottom, as well.

The market is suffering right now, to say the least. These days, it feels almost offensive to shill. When I read Li Jin’s “The New Creator Playbook” in this market, I wanted to push back. Who the hell is spending money on these right now? That said, creators don’t just stop needing money to survive when the market is bad. And some of them make really, really cool art. Should creator tokens exist, then? In this article, I’ll investigate the sustainability of DAOifying creators via creator token through both bull and bear.

What are creator tokens?

First things first, let’s define creator tokens and their ability to self-DAOify. Creator tokens are ERC-20 tokens issued by creators — writers, musicians, podcasters, artists, gamers, etc. — as a way to monetize their content and reward their supporters. These tokens function as a form of digital ownership or membership in a creator’s ecosystem. With this, holders can participate in creator-related governance, essentially DAOifying the creator and their brand.

What does that look like? Holders can use their tokens to:

-

Access exclusive content: Tokens can provide access to exclusive content not available to the general public, such as videos, live streams, or behind-the-scenes footage.

-

Purchase products or services: Tokens can be used as a form of payment for products or services provided by the creator, such as merchandise, coaching sessions, or personalized shoutouts.

-

Participate in community activities: Tokens can allow holders to participate in community activities, such as fan-voting on video ideas, Q&A sessions, or online events.

-

Trade: Tokens can be bought, sold, and traded on marketplaces, potentially providing a profit to holders that successfully flip their tokens.

-

Support their favorite creators: Tokens allow holders to support creators directly, helping them to build sustainable revenue streams and produce high-quality content. In line with traditional crypto ethos, this method evades any middleman involved in a creator’s business, like a record label or talent manager.

Often, creator tokens are used to DAOify the creator. DAOs provide a way for creators to empower their community by giving them a voice in decision-making via token voting. Creators can use DAOs to receive feedback from their audience, crowdfund their projects, and allocate resources based on their community’s preferences.

Exactly how creator DAOs function is pretty similar to protocol DAOs, only governance determines the decisions not of a business, but of a person (or people). These communities may gather via a creator token platform like Friends with Benefits or via an independent token drop and a Discord server. Creator DAOs use similar governance platforms to protocol DAOs, too, with discussions on Discourse and votes on Snapshot. That said, the reality of current creator DAOs is fairly small-scale, not requiring mechanisms beyond a bit of messaging-based discussion and a quick on-chain vote, to govern a creator’s decisions.

Even DAOs have founders; although decision-making is decentralized, the initial set-up of the DAO is usually determined by its founder, the creator. They may choose to interact daily with their community via Discord, monthly via Twitter, or anything inbetween. This decision of “how the DAO works” may influence fans interest in purchasing their token.

Furthermore, DAOifying oneself can help creators protect their intellectual property and control their brand. By issuing Creator Tokens, creators can ensure that their supporters have a stake in their brand’s success and that they are incentivized to support the creator’s work. In turn, the creator can leverage this loyalty to maintain control over their content and prevent unauthorized use of their intellectual property.

Let’s look at a few examples:

-

$ALEX, launched in 2020 by Alex Masmej, a web3 entrepreneur: ALEX allows holders to vote on key decisions related to Masmej’s personal and professional life, such as which projects to pursue and where to live.

-

$RAC, launched in 2021 by Grammy-winning musician RAC: RAC allows fans to access exclusive content, merchandise, and experiences, as well as participate in governance and decision-making related to RAC’s career.

-

$HUE, launched in HUE 2021 by NFT artist Trevor Jones: HUE allows holders to access exclusive content and experiences, as well as participate in governance and decision-making related to Jones’s web2 digital artwork and NFT projects.

In fact, several projects have popped up to allow creators to monetize their fan communities through social tokens — projects like Friends with Benefits, Rally, and Roll. Beyond dropping an initial token, creators can monetize with product revenue sharing, governance rewards, and microtransactions for more dedicated members of their community. Creator DAOs enable fan empowerment while retaining creator control.

DAOs and Creator Tokens are not just a passing trend. They offer real benefits for creators and their communities, regardless of market conditions. Whether people want to allocate resources towards these benefits, given market circumstances, is another question.

The Bull Case

In a lot of ways, creator tokens are a win-win. Using tokens, creators can monetize their work in a new way and build closer relationships with their fans and supporters. Holders have new opportunities to participate in and support their favorite creator’s ecosystem. (I would have literally died to buy a One Direction creator token during their heyday.) The tokens may also appreciate in value based on the success of the creator’s work and popularity of the community, giving creators an incentive to produce high-quality content and engage with their audience. With that, users are incentivized to invest in newer, smaller creators with the hope they may also profit from the creator’s future success.

In a system where it’s often financially unsustainable to quit your day job to commit to making music or writing without the promise of success, creator tokens provide creators with a guaranteed paycheck and a committed-from-the-get-go fanbase. Now, creators don’t have to sell their soul to a label/agency or swallow income uncertainty to financially justify full-time creation. This is huge, game-changing huge.

For a creator I believe in, it’s not a hard sell to buy their token. Let’s expand the scope: if you’d go to a concert, it’s likely you’d also invest in a creator token of that musician. You like their art and likely believe in their future success. Why not reap some financial benefits from it as well?

The Bear Case (or the reality of current times, if you will)

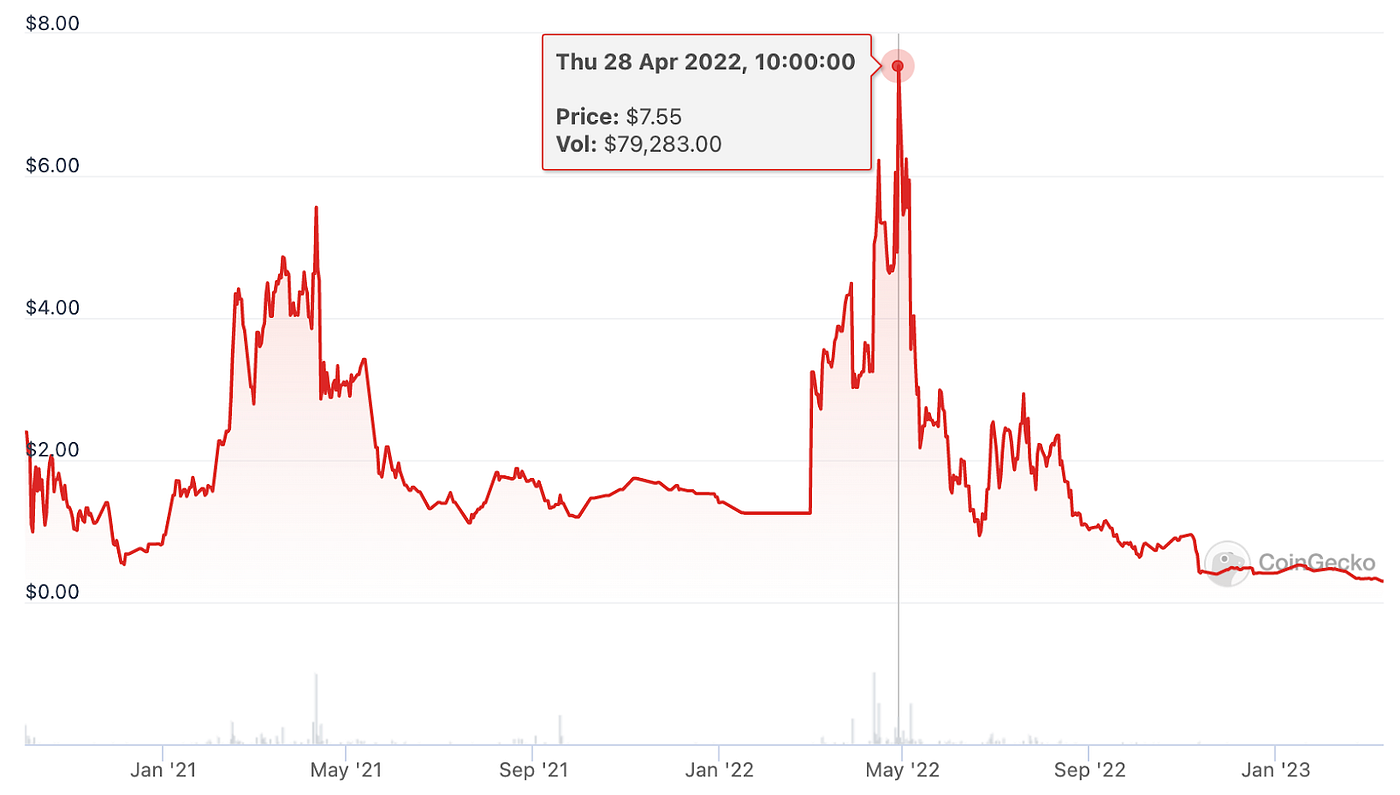

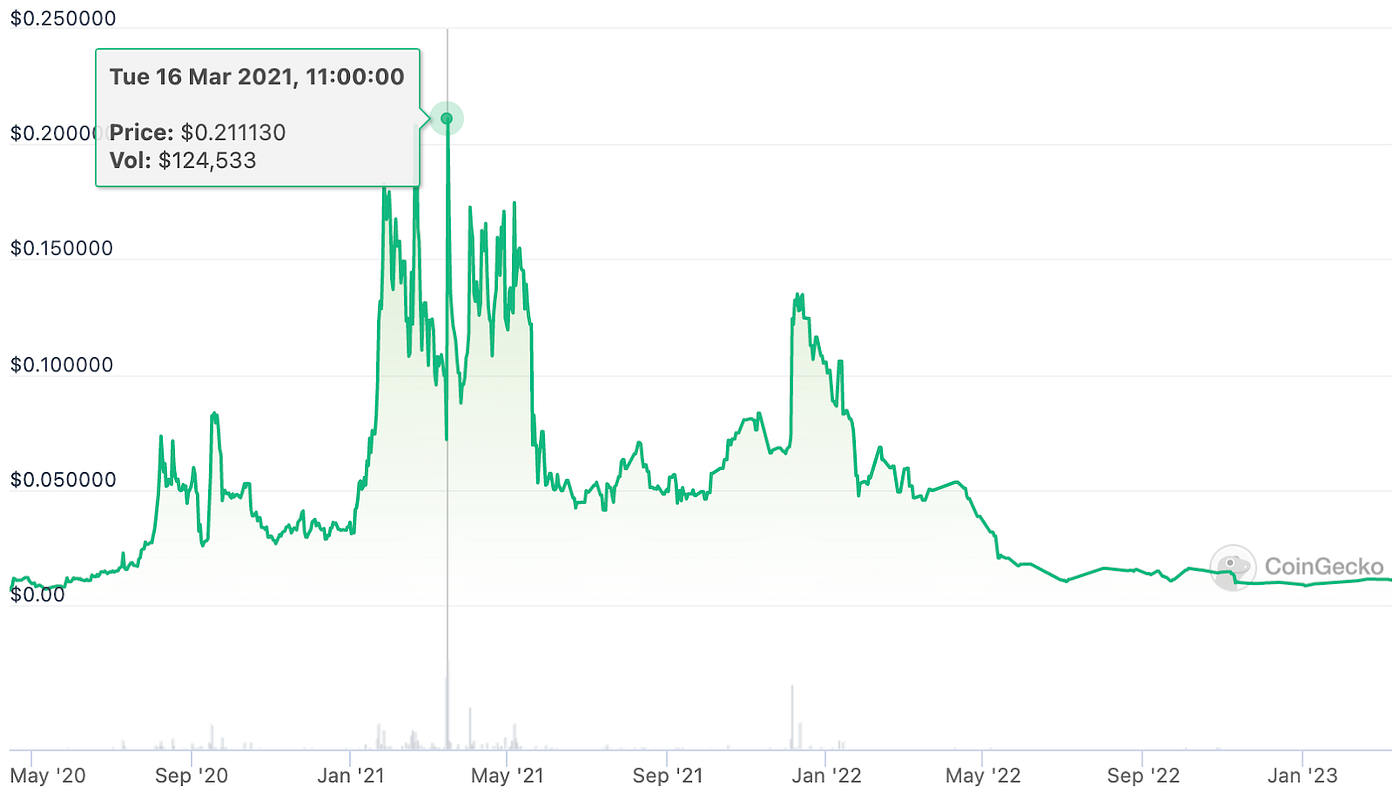

More than most sectors in crypto, social tokens have felt the effects of top and the bottom of the market, making them one of the most volatile sectors out there. The charts make it clear: social tokens have suffered during the bear. While you might still want to support your favorite creator, buying their creator token often signs you up to lose money while doing it. It’s an unfortunate side effect of the web3 ecosystem and creator tokens’ place in it — volatile tokens are seldom rewarded in the bear market. This is the dark side of direct support: while no middleman interferes with holders’ support of a creator during the bull market, similarly no middleman is there to bolster a creator’s support when token sales suffer during the bear market. A creator token is often the sole financier of a creator’s content.

Another con: regulation. As regulation increases, the “is this a security?” question becomes more relevant to creator tokens as well. If you launch a label and drop a creator token to invest in your label, that’s a textbook security that no longer flies under the regulatory radar these days. On the other hand, if your creator token acts merely as a way for fans to show support without benefits, fans may have little incentive to buy it. Without a company to protect them, independent creators may face more regulatory concerns than potential benefits of launching a token.

Additionally, now feels like an inappropriate time to ask people for financial support in return for non-necessities, like personalized shoutouts or the right to vote on someone’s next single. Volatile tokens and the DAOs backing them have faded during the bear market. People just cannot afford the risk.

All in all

Launching a creator token is certainly a risk these days. So, was my professor right? Does launching a token precipitate the beginning of the end for a creator, or are creator tokens the power-to-the-people move needed to disrupt the system? Overall, while creator tokens have the potential to be a valuable tool for creators to monetize their fan communities, their success is dependent on a range of factors, including market conditions, investor sentiment, and the underlying success of the creator or project. During bear markets, these factors may be working against the success of creator tokens, making them a more challenging sell to potential tokenholders.

Even still, creator tokens, when they work, are a massive unlock for creators. Removing the middleman is what crypto is all about, and it’s exciting to see this ethos put to work for independent artists.

But the charts don’t lie. What Li Jin calls “the new creator playbook” has not yet proven sustainable during the bear market. That said, it’s early days in creator tokens and I’d certainly love to directly support an up-and-coming musician, pixel artist, or any dude who will let me vote on where he lives. In this market, though, I simply can’t afford it. The groundbreaking value proposition of creator tokens makes me think they have a positive future. Even though I won’t be launching one anytime soon, I’m keen to watch the narrative play out.